Neste reports sluggish voluntary SAF demand

SOURCE: Neste Corp.

October 24, 2024

BY Erin Krueger

Neste Corp. on Oct. 24 released third quarter financial results, reporting that its renewables segment has been impacted by overcapacity and lower-than-expected voluntary demand for sustainable aviation fuel (SAF).

Heikki Malinen, president and CEO of Neste, said overcapacity in renewable fuel markets is creating pressure on margins. “Although we estimate that Neste has been able to demonstrate the best margins in the industry, supported by our distinctive competitive advantages for example in feedstock, pretreatment and global optimization, we need to accelerate our efforts to improve our competitiveness,” he said.

Advertisement

Advertisement

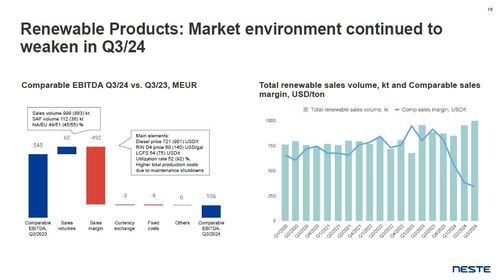

With the relatively weak market for renewable products and slower-than-anticipated SAF sales, Neste’s comparable EBITDA for the third quarter was EUR 293 million, compared to EUR 1.047 billion during the same period of last year. Renewable products comparable sales margin was $341 per ton, down from $912 per ton.

According to Malinen, there are both opportunities and uncertainties in the renewable market. He said demand for renewable fuels is expected to grow in 2025, driven by mandates and incentives. “However, voluntary SAF demand has so far not been realized as expected,” Malinen added. “Nevertheless, the long-term fundamentals in decarbonizing hard to abate sectors like aviation remain strong and supportive to SAF demand growth. At the same time, it is essential to ensure fair competition in the industry, and global trade policy topics continue to be highly important for us. The regulatory framework in the U.S. and related uncertainties around clean fuel production credit (CFPC) might require Neste to reoptimize its global production capacity and supply chains to maximize value. We anticipate more information during 2025.”

Advertisement

Advertisement

For the full year 2024, Neste expects continued market volatility. Renewable products sales volumes, however, are expected be up when compared to last year, reaching approximately 3.9 million metric tons. SAF is expected to account for 350,000 to 550,000 metric tons of that volume. The full-year average comparable sales margins for renewable products is expected to be the range of $360 to $480 per ton.

According to the company, renewable products’ full-year sales volume is impacted by the planned maintenance shutdowns and the ramp up timeline of Martinez Renewables joint operation. Singapore’s new line is scheduled to have an eight-week maintenance shutdown in the fourth quarter, after which full capacity is expected to be reached. The Martinez facility is targeted to be able to run at 100% by the end of the year. Neste also noted it optimizes its production capacity utilization in renewable products according to the market situation. SAF sales are expected to increase towards the end of the year.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events