Novozymes reports 32% increase in bioenergy sales in Q3

November 3, 2022

BY Erin Krueger

Novozymes released third quarter financial results on Nov. 3, reporting that bioenergy sales were up 32 percent for the three-month period and 26 percent for the first nine months of the year. Overall sales were up 6 percent for the quarter, and 9 percent so far this year.

Novozymes said the strong performance for its bioenergy segment was driven by a broad and innovative solution toolbox allowing for higher yields, throughput, and byproduct value capture for producers in a favorable market environment.

Advertisement

Advertisement

The North American market experience strong developments overall, according to Novozymes, supported by increased U.S. ethanol production. Outside of North America, performance was also strong and driven by innovation, capacity expansion of corn-based ethanol production in Latin America and supported by growth in solutions for biodiesel production.

For the third quarter, Novozymes also reported that sales of enzymes used in second-generation biofuels also did well and contributed to growth during the three-month period.

Advertisement

Advertisement

Following strong performance for the first nine months of 2022, Novozymes has raised its guidance for the full year performance of the bioenergy segment. The company now expects growth in the high-teens, up from the mid-teens. That growth is expected to be driven by innovation and supported by increased U.S. ethanol production, capacity expansion of corn-based ethanol production in Latin America, and market penetration with enzymatic solutions for biodiesel production along with enzyme sales for second-generation ethanol production.

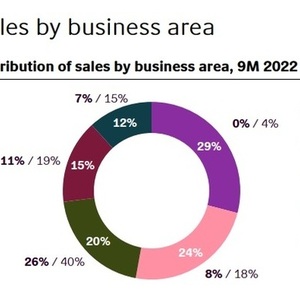

The bioenergy segment accounted for 20 percent of Novozymes sales during the first nine months of 2022. Household care; food, beverages and human health; grain and tech processing; and agriculture, animal health and nutrition accounted for 29 percent, 24 percent, 15 percent and 12 percent, respectively.

A full copy of Novozymes’ third quarter report is available on the company’s website.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events