Pacific Ethanol reports increased profits, revenue for Q1

SOURCE: PACIFIC ETHANOL

May 9, 2013

BY Holly Jessen

Comparing the first quarter of this year to the same time period in 2012 shows several key improvements for Pacific Ethanol Inc. The company reported its quarter one financial results in a conference call May 9.

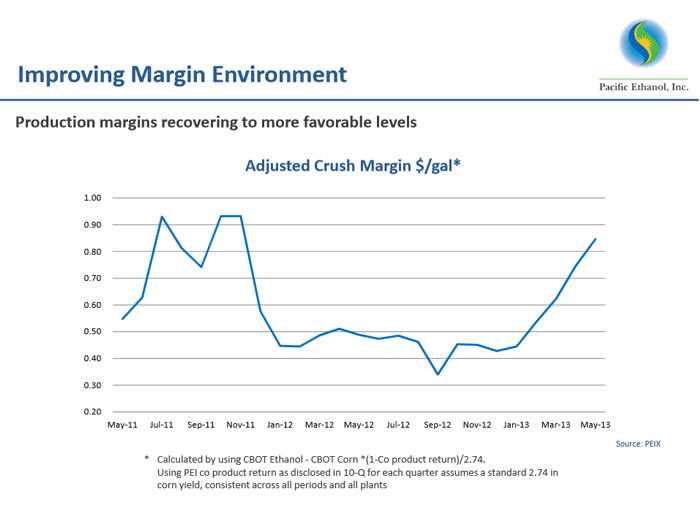

“Higher ethanol prices and more favorable market conditions in the second half of the quarter drove significant increases in both revenue and gross profit in the first quarter as compared to the prior year’s period,” said Neil Koehler, the company’s president and CEO. “When combined with the beneficial impact of our increased plant ownership in the first quarter and our continued efforts to control expenses, these factors resulted in a positive adjusted EBITDA [earnings before interest, taxes, depreciation, and amortization]. We are optimistic about the second quarter as April production margins demonstrated an even more material improvement, especially when compared to the historic lows experienced in 2012.”

Advertisement

The company sold the same amount of Pacific Ethanol-produced ethanol, 35.3 million gallons, in both quarters. On the other hand, the number of third-party gallons it sold went down from 79.5 million gallons to 65.4 million gallons. Overall, however, net sales were up, hitting $225.5 million in the first quarter, compared to $197.7 million in same time period last year. The increase came about due to the higher average price per gallon of ethanol sold, which was $2.60 for the first three months of this year and $2.34 in the first three months of 2012.

Total coproduct sold was 305,400 tons, a slight decrease from the 300,900 tons sold in the first quarter of 2012. On the other hand, coproduct return went up from 24.5 percent to 28.1 percent this year.

Gross profit was up too, hitting $800,000 compared to a gross loss of $7.5 million in the same time period last year. That’s an $8.3 million increase, which can be attributed to improved commodity margins, the company said.

Advertisement

Still, Pacific Ethanol did have a consolidated net loss of $6.6 million. However, that’s a 53 percent reduction from consolidated loss of $14 million in the first quarter of 2012.

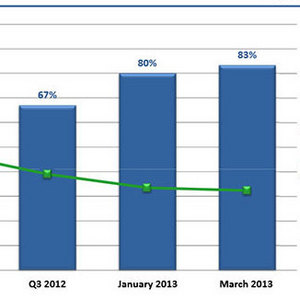

Pacific Ethanol’s cash balance went down to $4.3 million on March 31 (the end of the first quarter), compared to a cash balance of $7.6 million on Dec. 31. The company used about $4 million in cash to pay down a portion of its senior notes as well as purchase additional plant debt and ownership interests in the four Pacific Ethanol plants, bringing its total ownership to 83 percent.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events