Pacific Ethanol reports record fourth quarter, year-end results

Pacific Ethanol

February 28, 2014

BY Holly Jessen

Pacific Ethanol Inc. announced that it had achieved record gross profit and operating income in the fourth quarter and twelve month period that ended Dec. 31. The company also said it had paid off $23.7 million in debt during the fourth quarter and achieved record net sales for the year.

"Our fourth quarter 2013 results cap-off a year of record financial performance and significant progress for Pacific Ethanol,” said Neil Koehler, the company's president and CEO. “During 2013, we diversified our feedstock with sorghum and beet sugar, we added new revenue streams with corn oil separation, and we continued to drive cost efficiencies at the plants. These efforts, in combination with a better market environment for ethanol, translated into significant improvements in revenue, margins and Adjusted EBITDA on a year-over-year basis.”

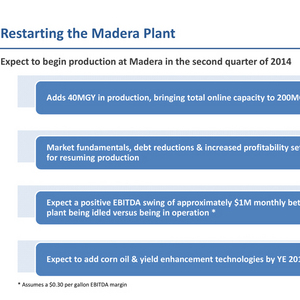

Pacific Ethanol owns 91 percent interest in New PE Holdco LLC, which owns four ethanol production facilities. That includes three operating plants in Boardman, Ore., Burley, Idaho, and Stockton, Calif., and one idled facility in Madera, Calif., which the company announced it would restart in the second quarter of 2014. “With strong market fundamentals in place, we believe now is the right time to restart Madera,” he said during a Feb. 27 conference call. In answer to a question, he said Pacific Ethanol would put $7 million into restarting the facility, half of which would become working capital and the other half capitalized expenditures.

Advertisement

Advertisement

The company also highlighted two purchases of sugar in October and November, through the Feedstock Flexibility Program for Bioenergy Producers. In total, the sugar represents about 20 million gallons of ethanol production, he said. The purchases saved about $700,000 in raw material costs and will be stored and used at the Burley and Boardman facilities.

The company also brought in additional revenue due to the fact that it added corn oil extraction at its Stockton and Burley plants. The plan is to add the technology at the Boardman and Madera facilities in 2014.

Advertisement

Advertisement

In the fourth quarter, Pacific Ethanol brought in net sales of $215.3 million, an increase from $197 million in the fourth quarter of 2012. The company said it was due to more gallons of ethanol sold, slightly offset by a reduction in the average sales price per gallon. Gross profit for the three month period was $21.6 million, compared to a gross loss of $4.7 million in the same time period of the previous year. This was attributed to significantly improved production margins and the fact that more gallons of ethanol were sold. Operating income was at $17.2 million, up from a loss of $5.8 million the previous year.

"We continue to make significant progress in strengthening our balance sheet,” said Bryon McGregor, company chief financial officer. “During the fourth quarter, we retired a total of $13.3 million in debt and subsequently paid down another $10.4 million in plant debt. This deleveraging facilitates our ability to restart our Madera plant, lowers our cost of borrowing and improves our profitability. It also aids in our efforts to refinance our plant debt to further lower our cost of capital and improve liquidity."

For the full year of 2013, Pacific Ethanol brought in net sales of $908.4 million, up from $816 million in 2012. Gross profits were a rosy $32.9 million, compared to a gross loss of $19.5 million the previous year. Operating income for the year was $18.9 million, up significantly from a loss of $31.7 million in 2012. That’s a $50.6 million improvement from 2012 to 2013. There was a $2 million loss to common stockholders in 2013, but that’s significantly less than the loss of $20.3 million experienced the previous year.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events