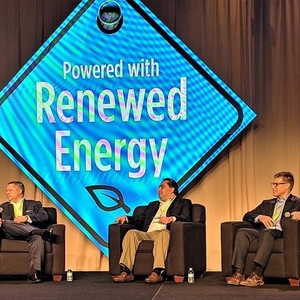

Retailers discuss experiences with ethanol at NEC

PHOTO: Matt Thompson

February 22, 2019

BY Matt Thompson

Retailers at the Renewable Fuels Association’s National Ethanol Conference told attendees that growing the market for ethanol comes down to education.

Bryan Goforth, executive vice president of Home Service Oil Company, a fuel distributer and retail store operator in Missouri, said the company’s recent decision to begin offering E15 and E85 at its nine retail locations was a matter of learning more about ethanol and how to sell it. “The education process was what really allowed us to understand the product and bring it to retail,” Goforth said, adding that he worked with RFA, state agencies and corn grower’s associations to gain a better understanding of ethanol.

Steve Walk, chief operating officer of Protec Fuel Management LLC, an ethanol fuel marketing company that focuses on Southern, South Eastern and East Coast markets, said his company has learned how best to price E15 in its markets through trial and error. He said Protec has found that pricing E15 at the same price as 87 octane gasoline, rather than below it, is an immediate benefit for the stores he works with. “When we priced [E15] to be equal with 87 [octane], sales significantly went up. And they went up literally the next day,” Walk said. He added that many drivers equate higher octane with a higher price, so selling the 88 octane E15 cheaper than regular 87 octane caused confusion among some customers. “The oil companies have done a phenomenal job over the years of selling the higher the octane, the better the fuel, and so you should pay a little bit more,” Walk said. “And so when you have that fuel price a little bit less than 87, there’s a conflict,” he said.”

Advertisement

Sam Odeh, CEO of Power Energy Corp. in Chicago, said that educating customers is also important. “All of our focus is trying to educate the consumer every single day on the benefits to them,” he said. But, he added, that can be difficult, especially regarding E15. “The consumer does not give us that time and the luxury to explain to them,” Odeh said. “They want simple. They want a clear message.” Allowing year-round sales of the fuel, he said, will eliminate confusion for their customers.

Walk agreed, and said “Flipping it back and forth just creates more confusion, not only with the dispenser, but within the employees at the store, when they get caught with questions by the customers.” He speculated that once E15 can be sold year-round, more large retailers will begin selling the fuel, as they won’t have to deal with the challenges of changing labels and fielding questions from customers about the fuel’s seasonal availability.

Walk, Odeh and Goforth also said education was key in securing funding to add E15 and E85 to their stores’ offerings. All three had taken advantage of USDA’s Biofuels Infrastructure Partnership Program, a grant program for state agencies to encourage marketing higher blends of ethanol. Goforth said RFA made him aware of the program. “If it was not for the BIP program we would not be selling E15 today,” he said. “It’s just that simple.”

Advertisement

Odeh agreed. “Had Had BIP not been there I think it would have been next to impossible for [adding E15 and E85] to work,” he said.

And all three said they’re pleased with the results of adding ethanol to their product mixes. Goforth said that while Home Service Oil is fairly new to ethanol and they’re still evaluating its performance, so far, they’re pleased. “It’s been a really positive development for us and our organization and in some … retail locations, our E15 and E85 sales are upwards of 23 percent of what our E10 sales are,” he said.

Walk said, on average, across all of Protec’s markets, selling E85 and E15 led to increased sales, without decreases in E10 sales. “We haven’t seen E10 sales go down, we’ve actually seen it go up 3 percent,” he said. “On top of that, we’ve seen another 15 percent increase in overall volumes with the ethanol sales.”

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events