RFA questions fairness of Big Oil tax subsidies

Renewable Fuels Association

April 18, 2016

BY Renewable Fuels Association

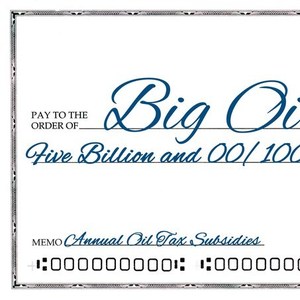

April 18 is tax day. While hardworking Americans will receive an average of more than $2,800 in refunds, did you know that oil producers and refiners receive $4 billion–6 billion in federal tax incentives and subsidies every year? What makes that worse is that many of those favorable tax provisions never expire.

The U.S. ethanol industry agreed to let its tax incentive expire in 2011, while oil producers continue to cling to subsidies that have existed for more than a century. The Joint Committee on Taxation recently estimated that elimination of certain “fossil fuel preferences” (i.e., subsidies) would save U.S. taxpayers at least $24.5 billion—or roughly $210 per U.S. household—between 2015 and 2020.

“Big Oil needing any government assistance is preposterous,” said Renewable Fuels Association President and CEO Bob Dinneen. “Why would an incumbent industry that has a virtual monopoly at the pump need taxpayer dollars to compete?

“On this tax day, Congress should seriously consider repealing this absurd and costly corporate welfare. Consumers will benefit when there is a truly free market in motor fuel, when alternatives like ethanol have access to the pump, when a variety of biofuel blends (E15, E25, E85) are accessible to consumers and when taxpayers no longer have to subsidize the most profitable industry on the planet. Until then, programs like the renewable fuel standard are all we have to compel some level of competition and cost-control on an otherwise broken and unfair market.”

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events