Study reveals economic impact of U.S. ethanol industry

ABF Economics

February 20, 2014

BY Erin Krueger

The Renewable Fuels Association has released a study conducted by ABF Economics that demonstrates the impact of the ethanol industry on jobs and energy independence. The study, titled “Contribution of the Ethanol Industry to the Economy of the United States,” examines the impact of the ethanol industry on job creation, economy, household income, and foreign oil displacement last year. The report was authored by John Urbanchuk, managing partner of ABF Economics.

According to the report, 2013 marked the first commercial-scale production of cellulosic ethanol and increased investment in new capacity for ethanol from cellulose and other advanced feedsocks. Total ethanol production in the U.S. increased by approximately 0.4 percent compared to 2012, reaching about 13.3 billion gallons.

RFA data indicate that approximately 2010 ethanol plants in 28 states were in operation at the end of 2013. These facilities have an estimated combined nameplate capacity of 14.9 billion gallons. An additional 167 million gallons of new capacity were under construction as of the close of last year, with 82 million gallons of that volume being cellulosic and advanced capacity.

Advertisement

Advertisement

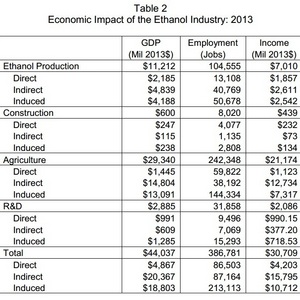

The report breaks down ethanol industry expenditures into three primary categories, including construction of new facilities, ongoing operations and research and development. The analysis estimates the U.S. ethanol industry made $480 million in construction expenditures last year, along with $40 billion in expenses related to ongoing operations. Most of that $40 billion went to raw material purchases, with the report estimating ethanol producers used approximately 4.8 billion bushels of corn last year, valued at more than $29.4 billion. The report also estimates $1.47 billion in research and development expenditures were made last year.

Regarding coproducts, the report estimates U.S. ethanol producers produced 35.2 million tons of distillers grains last year, along with 2.9 billion pounds of corn oil. According to the report, these products have an aggregate market value of about $8.8 billion.

The report estimates the ethanol industry results in a total of $44.037 billion in GDP, including $4.267 billion in direct GPD, $20.067 billion in indirect GDP, and $18.803 billion in induced GDP. The industry was responsible for a total of 386,781 jobs, including 86,503 direct jobs, 87,164 indirect jobs and 213,113 induced jobs. The U.S. ethanol industry also generated $30.709 billion in income, including $4,203 billion in direct income, $15795 in indirect income and $10.712 in induced income.

According to the report, the combination of GDP and household income supported by the ethanol industry contributed more than $4.5 billion to the Federal Treasury last year. Benefits to state and local governments also reached $3.8 billion in 2013.

Advertisement

Advertisement

The 13.3 billion gallons of ethanol produced by U.S. producers last year reduced oil imports by an estimated 476 million barrels, or about 13 percent of the total expected U.S. and petroleum product imports in 2013. The analysis estimates the value of the displaced crude to be $48.2 billion.

Bob Dinneen, president and CEO of the Renewable Fuels Association, commented on the new study, noting, “Last year we fought, and we continue to fight, against naysayers determined to end the renewable fuel standard. These numbers should silence the opposition as the ethanol industry is clearly helping individuals, families, communities, and our country by creating jobs, displacing oil imports, and contributing to America’s economy.”

A full copy of the report can be downloaded from the RFA website.

Related Stories

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

Upcoming Events