The Andersons restarts 2 ethanol plants

May 6, 2020

BY Erin Krueger

The Andersons has resumed ethanol production at its ethanol plants in Albion, Michigan, and Denison, Iowa, after idling all five of its ethanol facilities in March due to falling liquid fuel demand caused by the COVID-19 pandemic.

Pat Bowe, president and CEO of The Andersons, made the announcing during a first quarter earnings call held by the company on May 6. He said maintenance work was completed at all five facilities during the recent shutdown. With the 140 MMgy Albion facility and the 65 MMgy Denison plant now operating, Bowe said the company is producing ethanol at less than half its overall capacity, but stressed the two plants are running well.

Advertisement

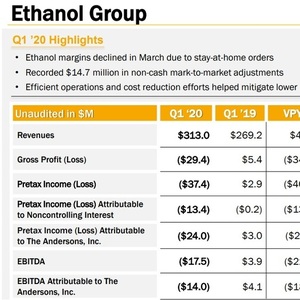

During the call, Bowe noted that the pandemic had a significant impact on the company’s first quarter results. “The ethanol group was the most directly impacted of our four business units, but both the trade and rail groups were affected as well,” he said.

Bowe noted approximately 90 percent of the company’s $30 million decrease in year-over-year adjusted pre-tax income came from the ethanol group. Moving forward, Bowe said The Andersons expects ethanol demand to improve as the U.S. economy reopens. “We operate highly efficient plants and are well-positioned to benefit from that when it happens,” he said.

The ethanol group reported a pretax loss attributable to the company of $24 million in the first quarter, compared to $3 million in pretax income reported for the same period of 2019. The group recorded negative adjusted EBITDA attributable to the company of $14 million in the first quarter of 2020, compared to $4.1 million in adjusted EBITDA reported for the same period of last year.

Advertisement

According to The Andersons, the ethanol group’s decision to aggressively halt production and use that down time to maintain its facilities while protecting its employees and conserving cash appear to have been the right moves. The company said margins are now begining to improve and said production will be brought back online as ethanol demand, logistics and margin structure improve.

Overall, The Andersons reported a pretax loss of $39.1 million for the quarter, compared to a pretax loss of $19.4 million during the same period of last year. Adjusted pretax loss was $37.8 million, compared to a loss of $7.9 million. Net loss was $37.7 million, compared to a $14 million net loss reported for the first quarter of 2019. Earnings per share were negative $1.15, compared to negative 43 cents. Adjusted earnings per share fell to negative $1.32, compared to negative 16 cents for the same period of 2019. EBITDA was $9.9 million, down from $30.1 million, while adjusted EBITDA attributed to the company was at $14.7 million, down from $41.8 million during the first quarter of 2018.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events