U of I economist discusses RIN price increases

FarmDoc Daily

October 6, 2016

BY Ann Bailey

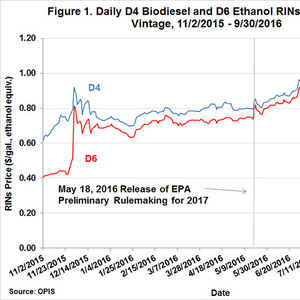

Over the past few months, renewable identification numbers (RINs), which are used by obligated parties to demonstrate compliance with the renewable fuel standard (RFS) have come under close scrutiny from some members of the ethanol industry, even to the point of a few accusations of fraud and manipulation. But there is a reasonable explanation for the increase in RINS prices in 2016, said Scott Irwin, a professor in the University of Illinois Champagne-Urbana Department of Agricultural and Consumer Economics.

“The starting point is the fact that biodiesel seems to be the marginal gallon for meeting the conventional ethanol mandate, due to the E10 blend wall and related infrastructure constraints,” Irwin said in his Oct. 5 FarmDoc Daily column.

Advertisement

Advertisement

“When this occurs D6 ethanol RINS prices closely track D4 biodiesel prices,” Irwin noted in FarmDoc Daily. It follows, then, that the key to understanding the general increase of RINS prices this year is to understand the factors that that drive biodiesel RINS prices, he said. A review of the relevant data demonstrates that the increase in 2016 RINS likely is a result of the impending expiration of the $1 per gallon diesel credit at the end of the year, Irwin said.

“Uncertainty about the blenders credit increase the odds that blending losses will be larger in future years, which shows up in the value of the RINS ‘option,’” he said. “This component of RINS prices in 2016 is either similar to, or smaller than, what was observed in previous years when the tax credit also as scheduled to expire.” That means that, though, it can’t be said with certainty that the RINS market has not been manipulated, there is a logical economic explanation to the price increases this year, Irwin said.

To read Irwin’s full FarmDoc Daily report on RINS click here.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events