US ethanol production up 6%, weekly ending stocks fall by 3%

June 3, 2020

BY Erin Krueger

U.S. fuel ethanol production increased by nearly 6 percent the week ending May 29, while weekly ending stocks of fuel ethanol fell by approximately 3 percent, according to data released by the U.S. Energy Information Administration on June 3.

Ethanol production increased to an average of 765,000 barrels per day the week ending May 29, up from an average of 724,000 barrels per day the previous week. The week ending May 29 marks the fifth consecutive week of growth following sharp declines that began in late March and persisted throughout April due to market impacts caused by the COVID-19 pandemic. Production was down 279,000 barrels per day when compared to the same week of 2019, and down 314,000 barrels per day when compared to the final week of February 2020, before COVID-19 began to impact U.S. fuel markets.

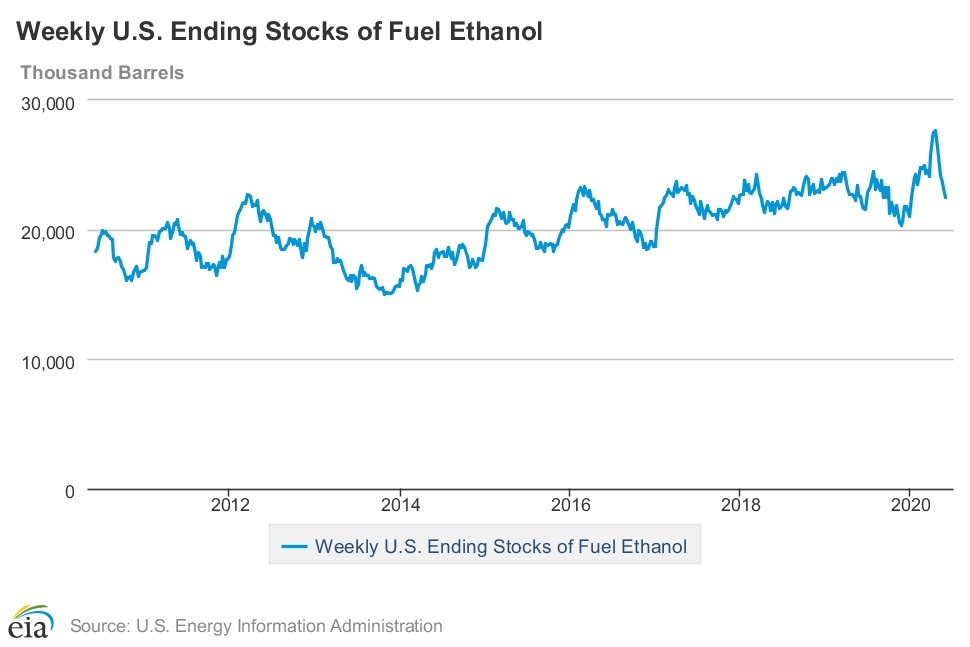

Weekly ethanol ending stocks fell to 22.476 million barrels the week ending May 29, down from 23.176 million barrels the previous week. May 29 marks the sixth consecutive week of falling ethanol stocks following a new record high that was set at 27.689 million barrels the week ending April 17. When compared to the same week of last year, weekly ethanol ending stocks were down 77,000 barrels.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events