CoBank highlights ethanol industry's strong Q2

July 14, 2022

BY Erin Voegele

The U.S. ethanol industry delivered a very strong second quarter, according to the latest quarterly report issued by CoBank’s Knowledge Exchange on July 14. Ethanol profits and production remain robust despite record gas prices, according to the report.

The ethanol industry experienced few visible signs of demand destruction during the second quarter despite a spike in retail gasoline prices, rising inflation, aggressive Federal Reserve interest rate actions, a significant showdown in the U.S. economy and deteriorating consumer sentiment, according to CoBank.

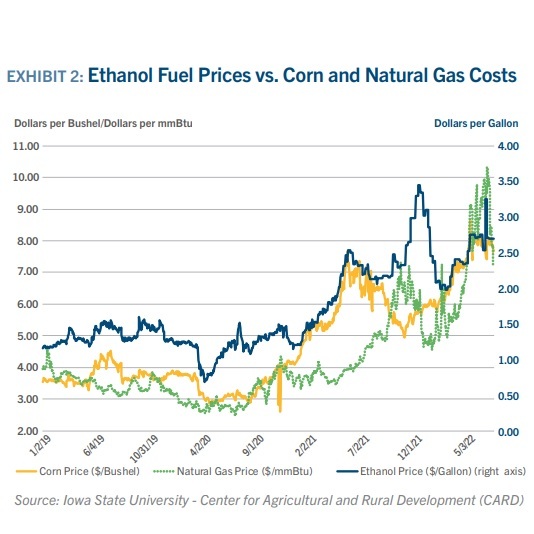

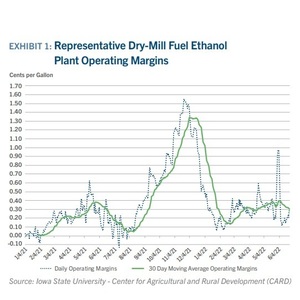

The report indicates that ethanol production during the second quarter was down slightly when comparted to the first quarter, averaging 15.5 billion gallons on an annualized basis. According to CoBank, second quarter operating margins were at 33 cents per gallon, well above the five-year average of 22 cents per gallon. CoBank said the relatively high margins were driven by a 16 percent increase in fuel ethanol prices, which exceed input costs of corn and natural gas.

U.S. ethanol exports reached a four-year high in April, at 185 million gallons, with sales diversified among several key trading partners. Overall, ethanol exports for the first four months of the year were up 67 percent, according to CoBank. U.S. exports of dried distillers grains (DDGS) were also up during the fourth month period, but at a lower rate of 8 percent. The report also notes that consumer gasoline demand remains stable despite prices that have reached $4.88 per gallon, up from $3.10 per gallon a year ago.

Advertisement

Advertisement

A full copy the CoBank Knowledge Exchange’s latest quarterly report can be downloaded from the company’s website.

Advertisement

Advertisement

Related Stories

Metro Ports on April 8 announced significant environmental milestone in its voluntary efforts to reduce greenhouse gas emissions. By switching to renewable diesel, the organization reduced its carbon emissions by 85%.

CoBank latest quarterly research report highlights current challenges facing the biobased diesel industry. The report cites policy uncertainty and trade disruptions due to tariff disputes as factors impacting biofuel producers.

The U.S. EIA on April 15 released its Annual Energy Outlook 2025, which includes energy trend projections through 2050. The U.S. DOE, however, is cautioning that the forecasts do not reflect the Trump administration’s energy policy changes.

Iowa Secretary of Agriculture Mike Naig on April 10 announced that the Iowa Renewable Fuels Infrastructure Program board recently approved 114 project applications from Iowa gas stations, totaling more than $2.88 million.

The USDA on April 14 announced the cancellation of its Partnerships for Climate-Smart Commodities program. Select projects that meet certain requirements may continue under a new Advancing Markets for Producers initiative.

Upcoming Events