Export Expectations

PHOTO: USGC

October 12, 2021

BY Matt Thompson

In early 2020, with the U.S. in the grips of the early stages of the Covid-19 pandemic, ethanol production slowed, as stay-at-home orders curbed demand for gasoline. While there were domestic implications to the slowdown in production, the pandemic also affected the industry’s exports.

Globally, less driving “really weighed on fuel ethanol demand around the world,” says Brain Healy, director of global ethanol market development for the U.S. Grains Council. “In marketing year 2020-’21 (Sept. 1-Aug. 31), we finished off at 1.3 billion gallons,” he adds. “That’s our fourth largest export year for ethanol. In terms of a global production standpoint, production was down about 13 percent in calendar year 2020 and it hasn’t recovered yet, even in this year, to the 2019 levels that were at a historic high,” Healy says.

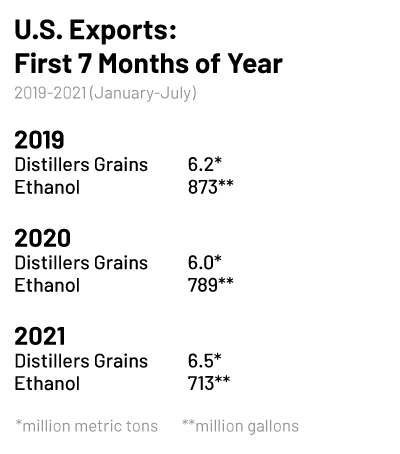

According to the USDA’s Foreign Agriculture Service, the U.S. exported $2.3 billion worth of ethanol in 2020. The volume of ethanol exported was 9 percent lower than 2019. Through July of this year, the U.S. has exported 2.7 billion liters of ethanol, or 713 million gallons. In 2019, the total exported was 5.4 billion liters, or 1.3 billion gallons—and the July pace that year was north of 870 million gallons, 18% greater than this year’s mark.

Exports of U.S. DDGS also declined, says Cary Sifferath, senior director of global programs with the U.S. Grains Council. He notes though, that the slowdown in ethanol production had a bigger impact on DDGS exports than any declines in demand. “Obviously, certain markets were having their economies being affected by Covid, which may have affected overall meat consumption,” he says. “But just the slowdown in ethanol production with less actual supplies of DDGS was probably the biggest slowdown factor for DDGS exports.”

While the ongoing pandemic adds uncertainty to the future of ethanol demand and exports, Healy and Sifferath say the volume of ethanol and DDGS exports have begun to rebound. “The data I have now, for September through July of the 2020-’21 marketing year, says we’re actually up 17 percent on exports of DDGS to Mexico versus a year ago,” Sifferath says.

Exports of DDGS in calendar year 2019 were 10.8 million metric tons, and 6.2 million metric tons by July of that year. Through this July, the U.S. had exported 6.4 million metric tons, a good calendar year figure, even if the marketing year number paints a slightly different picture.

“We’re not quite back to normal yet,” Healy says. “If you look at market year 2020, that still had several months of normal demand included in that year’s numbers. I would say we’re on track to getting back towards the same level we were at last year,” Healy says, adding that at the end of this marketing year, ethanol exports will be 5 or 6 percent lower than they were the previous year.

Eyes on China

Late in 2019, during the very early stages of the outbreak, the phase I trade agreement with China was signed. At the time, it was unclear just how Covid-19 would affect the country’s commitment to purchase U.S. agricultural goods, like ethanol and DDGS.

Two years on, Healy says, China has imported 130 million gallons of U.S. ethanol this marketing year. “That’s not quite near the levels that had been expected under a full phase I agreement, or under their full E-10 implementation,” he says. But there is reason to be optimistic about the role China will play in demand for exports. He says that while the nation-wide E-10 mandate has been delayed, there are still policies on the provincial level in the country that drive demand for ethanol. “I think there’s still optimism about fulfilling phase I agreement and I think it’s pretty well predicated on how these administrations interact with each other,” Healy says.

DDGS is a different story, Sifferath says. Because of anti-dumping and countervailing duties placed on U.S. DDGS, along with retaliatory tariffs, the cost of getting distillers grains to China is prohibitive, and Sifferath adds, the phase I agreement didn’t address the duties and tariffs. “Right now, there’s limited amounts of DDGS going to China because of those anti-dumping and countervailing duties that were not resolved as part of the phase I agreement,” he says. But imports of DDGS into China have the potential to increase, if the country decides not to extend those duties. Sifferath says he expects China will make that decision this year.

Continued Commitment

While exports of U.S. ethanol and DDGS continue to climb following the lows reached during the height of the pandemic, Sifferath and Healy both say the Grains Council remains committed to expanding markets abroad, despite the challenges Covid-19 has brought. “Our greatest strength is that we are in countries that we have programs in,” Healy says. While the council has transitioned to fewer in-person events in favor of more Covid-friendly online events, its mission remains the same. “We just wrapped up a carbon summit in Australia as they look to change their fuel standards, as an example. Korea just had another summit looking at how ethanol can contribute to their 2050 net-zero carbon emissions goals. So, for us, it’s been business as usual, just a new platform to do so,” he says.

Sifferath agrees. “Going back to March and April of 2020, we’ve transitioned our programs globally into a virtual type of programming and our international staff has just come up with great and creative ways to do things virtually,” he says.

Onward and Upward

Exports are not yet back to what they were prior to the pandemic, however both Sifferath and Healy agree that they’re headed in the right direction. “We’re just under 10 percent ahead of exports shipments where we were a year ago,” he says. “We’re still probably down a little bit from the peak of the 2018-’19 marketing year. Having China being able to come back without having that anti-dumping and countervailing duty would definitely help increase exports and even a continued healthy ethanol market here in the U.S., which keeps production moving or even expanding, because we can only export and ship as much DDGS as gets produced and isn’t consumed domestically.”

Healy says that while the pandemic certainly played a role in a slump in ethanol exports, another important factor is policies that restrict the entrance of U.S. ethanol. “When a country like Brazil sets a 20 percent tariff on a U.S. product, that’s extremely disruptive to trade, it’s disruptive to the global narrative around using ethanol and working together in collaboration, and it impacts our exports,” he says. “It’s the same in any other country that either delays a policy, reduces a blend rate in-country, or the inability to have bilateral trade deals, or multilateral trade deals. That’s problematic in terms of market access. It remains critical that those tariff issues are resolved with certain markets.”

And Healy is optimistic that policies that aim to reduce carbon emissions worldwide will help drive ethanol demand in the future. “A number of countries are creating policies to eliminate carbon or reduce carbon emissions from the transport sector,” he says.

“These policies that countries are setting today, this global attention to carbon and the need to monitor and reduce its overall emissions, is going to be key for driving demand for a product that’s proven itself in the U.S. market, the EU market, the Brazilian market—wherever they’re using ethanol—that it’s able to make these carbon emission reduction contributions.”

Author: Matt Thompson

Contact: editor@bbiinternational.com

Advertisement

Advertisement

Related Stories

The Michigan Advanced Biofuels Coalition and Green Marine are partnering to accelerating adoption of sustainable biofuels to improve air quality and reduce GHG emissions in Michigan and across the Great Lakes and St. Lawrence Seaway.

Sen. Roger Marshall, R-Kan., and Rep. Marcy Kaptur, D-Iowa, on April 10 reintroduced legislation to extend the 45Z clean fuel production credit and limit eligibility for the credit to renewable fuels made from domestically sourced feedstocks.

Representatives of the U.S. biofuels industry on April 10 submitted comments to the U.S. Department of Treasury and IRFS providing recommendations on how to best implement upcoming 45Z clean fuel production credit regulations.

EIA reduces production forecasts for biobased diesel, increases forecast for other fuels, including SAF

The U.S. Energy Information Administration reduced its 2025 forecasts for renewable diesel and biodiesel in its latest Short-Term Energy Outlook, released April 10. The outlook for “other biofuel” production, which includes SAF, was raised.

FutureFuel Corp. on March 26 announced the restart of its 59 MMgy biodiesel plant in Batesville, Arkansas. The company’s annual report, released April 4, indicates biodiesel production was down 24% last year when compared to 2023.

Upcoming Events