Green Plains reports strong Q2

August 2, 2021

BY Erin Voegele

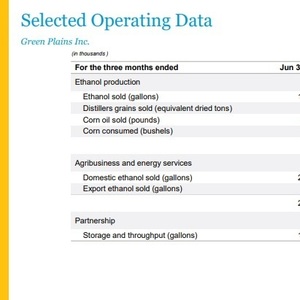

Green Plains Inc. released second quarter financial results on Aug. 2, reporting improved earnings and progress with initiatives related to ultra-high protein, corn oil, clean sugar and carbon capture and storage (CSS). The company’s ethanol plants operated at approximately 80 percent capacity during the period.

“The first half of 2021 has been transformational for Green Plains, culminating with a strong second quarter,” said Todd Becker, president and CEO of Green Plains. “We continue to pursue our path to 2024 with an intense focus on executing our strategy while strong financial results from the second quarter have provided additional liquidity to achieve our transformation plan. We are executing on key milestones to deploy ultra-high protein technology across our platform, including naming Fagen as our exclusive construction partner and breaking ground at an additional location. As part of our execution plan, we have ordered essential long lead time equipment for our projects, keeping each location on a path toward on-time completion.”

“We are establishing the key building blocks across our company to drive sales, marketing, innovation and technology goals and are making great progress in each of our four strategic areas of growth: ultra-high protein, renewable corn oil, clean sugar and carbon capture and sequestration,” Becker added. “In each of these areas our focus remains on delivering on our 2024 and 2025 targets.”

Advertisement

Becker said the company’s consolidated margin for the second quarter was 37 cents per gallon, which was aided by several factors, including a strong spot market and record production yields for both ethanol and corn oil.

Green Plains produced 191 million gallons of ethanol during the second quarter, Becker said, which equates to approximately an 80 percent capacity utilization rate. Production has been trending higher as the company’s brings sites online from its Project 24 initiative and will continue to increase once the Madison, Illinois, facility resumes production, he added. Becker also cautioned that margin structure going into the third quarter could impact the company’s capacity utilization in the coming months.

Longer-term, Becker said Green Plains expects its Project 24 initiative to be complete by the end of the year. That initiative aims to reduce the company’s per-gallon operating expense to 24 cents. He also discussed the company’s strategy to focus on ultra-high protein, renewable corn oil, specialty alcohols, clean sugar and carbon.

Advertisement

Regarding protein, Becker said the high-protein project at the Wood River, Nebraska facility, is nearly complete. High-protein projects at the Central City, Nebraska; Obion, Tennessee; and Mount Vernon, Indiana, plants are expected to come online next year.

For CCS, Becker said Green Plains is carefully reviewing the prospect of investing in Summit Carbon Solutions, which is planning to develop a large-scale CCS project across the Midwest. Green Plains is also exploring direct carbon injection for its facilities in Madison, Illinois; Mount Version, Indiana; and Obion, Tennessee. “Carbon capture is a critical piece of our sustainability goals,” Becker said.

Green Plains reported net income attributable to the company of $9.7 million, or 20 cents per diluted share, compared to a net loss of $8.02 million, or 24 cents per diluted share, for the same period of last year. Revenues were $724.4 million, compared to $388 million for the second quarter of 2020.

Related Stories

The Michigan Advanced Biofuels Coalition and Green Marine are partnering to accelerating adoption of sustainable biofuels to improve air quality and reduce GHG emissions in Michigan and across the Great Lakes and St. Lawrence Seaway.

The USDA reduced its outlook for 2024-’25 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released April 10. The outlook for soybean oil pricing was revised up.

Sen. Roger Marshall, R-Kan., and Rep. Marcy Kaptur, D-Iowa, on April 10 reintroduced legislation to extend the 45Z clean fuel production credit and limit eligibility for the credit to renewable fuels made from domestically sourced feedstocks.

Representatives of the U.S. biofuels industry on April 10 submitted comments to the U.S. Department of Treasury and IRFS providing recommendations on how to best implement upcoming 45Z clean fuel production credit regulations.

EIA reduces production forecasts for biobased diesel, increases forecast for other fuels, including SAF

The U.S. Energy Information Administration reduced its 2025 forecasts for renewable diesel and biodiesel in its latest Short-Term Energy Outlook, released April 10. The outlook for “other biofuel” production, which includes SAF, was raised.

Upcoming Events