The Andersons reports strong Q4, record full year earnings

February 20, 2023

BY Erin Voegele

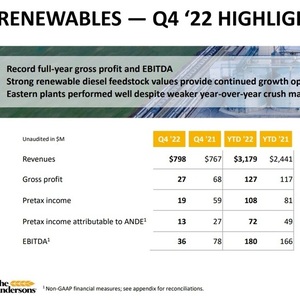

The Andersons Inc. released fourth quarter financial results on Feb. 14, reporting strong quarterly results and record full year earnings. The company’s renewables segment achieved good results despite lower ethanol margins.

"We finished the year with strong fourth quarter results, particularly in our trade segment,” said Pat Bowe, president and CEO of The Andersons. “Our merchandising teams and grain assets had outstanding results from improving basis after harvest, sales into destinations experiencing crop deficits, storage income and rising propane values. With another record quarter, our Trade business is positioned to execute well in these favorable markets with continuing strong ag fundamentals.”

"We enjoyed very good results in renewable fuels on solid renewable feedstock values but didn't experience the outsized ethanol margins that occurred in the fourth quarter of 2021 due to supply chain disruptions,” Bowe continued. “The ethanol crush margin outlook is currently challenged but we expect this to improve with seasonal maintenance shutdowns and increased driving demand. Our plant nutrient segment had mixed results with good fall applications and farmer engagement on specialty liquids but more limited early orders of granular fertilizer as buyers are waiting for declining prices to stabilize. With strong farm income, this sets us up well for a higher volume spring planting season although likely at more normalized margins. Our growth project pipeline remains robust, and we expect to close several transactions and continue making growth investments in 2023."

Advertisement

Advertisement

The renewable segment benefited from improved renewable diesel feedstock merchandising results, with the volume merchandised more than doubled when compared to the fourth quarter of 2021. The Andersons also reported increases sales volumes for ethanol, corn oil and feed ingredients, driven by higher production and additional third-party sales form the merchandising business.

Moving into 2023, spot ethanol crush margins have declined, but are expected to seasonally improve with driving demand, according to The Andersons. Corn oil demand is expected to remain high, and merchandising of low-carbon-intensive renewable feedstocks should remain strong as additional renewable diesel facilities begin operations driving significant growth.

Advertisement

Advertisement

The Andersons’ renewables segment reported pretax income of $19 million and pretax income attributable to the company of $13 million in the fourth quarter, compared to a record pretax income of $59 million and pretax income attributable to the company of $27 million in the same period of the previous year. Ethanol board crush margins for the fourth quarter were down more than 90 cents per gallon when compared to the same period of 2021. Renewables EBTIDA was $36 million in the fourth quarter, compared to $78 million during the same period of 2021. For the full year, the renewables segment reported $180 million in EBITDA, up $14 million when compared to 2021.

Overall, The Andersons reported $15 million in net income from continuing operations attributable to the company for the fourth quarter, compared to $33 million during the same period of 2021. Adjusted net income from continuing from continuing operations attributable to the company of $34 million, compared to $39 million. Diluted earnings per share from continuing operations was 44 cents, down from 95 cents. Adjusted diluted per share from continuing operations reached 98 cents, down form $1.14 during the same quarter of 2021.

For the full year 2022, The Andersons reported net income from continuing operations attributable to the company of $119 million, up from $100 million in 2021. Adjusted net income from continuing operations attributable to the company was $139 million, up from $98 million. Diluted earnings per share from continuing operations was $3.46, compared to $2.94. Adjusted diluted earnings per share from continuing operations was $4.05, up from $2.89 in 2021.

Related Stories

The Michigan Advanced Biofuels Coalition and Green Marine are partnering to accelerating adoption of sustainable biofuels to improve air quality and reduce GHG emissions in Michigan and across the Great Lakes and St. Lawrence Seaway.

EIA reduces production forecasts for biobased diesel, increases forecast for other fuels, including SAF

The U.S. Energy Information Administration reduced its 2025 forecasts for renewable diesel and biodiesel in its latest Short-Term Energy Outlook, released April 10. The outlook for “other biofuel” production, which includes SAF, was raised.

FutureFuel Corp. on March 26 announced the restart of its 59 MMgy biodiesel plant in Batesville, Arkansas. The company’s annual report, released April 4, indicates biodiesel production was down 24% last year when compared to 2023.

Neste has started producing SAF at its renewable products refinery in Rotterdam. The refinery has been modified to enable Neste to produce up to 500,000 tons of SAF per year. Neste’s global SAF production capacity is now 1.5 million tons.

Tidewater expects to make final investment decision on proposed SAF project during second half of 2025

Tidewater Renewables Ltd. has reported that its biorefinery in Prince George, British Columbia, operated at 88% capacity last year. A final investment decision on the company’s proposed SAF project is expected by year end.

Upcoming Events