Making A Splash

PHOTO: GREEN PLAINS INC.

April 12, 2021

BY Lisa Gibson

Walter Cronin says Green Plains Inc. is setting itself up to play a major role in a global market he expects the U.S. to dominate in the coming years. As chief commercial officer at Green Plains, Cronin possesses an advanced knowledge of animal nutrition, as well as a passion for veg oils that likely spills into conversations outside of feed ingredients.

Drawing on that expertise, Cronin explains his theory of circulating aquaculture coming to the U.S. in force and shares the methods Green Plains is using to get ahead of it and secure a top spot in the feed market that will sustain it.

“The U.S. is going to ultimately dominate in aquafeeds and in aquaculture because of our incredible efficiencies in grain and oil production,” he says, adding that feed hoards 70% of the cost in circulating salmon production. “We’re at an extreme competitive advantage just starting there.”

Green Plains is also occupying the pet feed market, while maintaining more traditional livestock markets as well.

Jerry Shurson, animal nutritionist and professor in the Department of Animal Science at the University of Minnesota, agrees that fish and pet feed hold potential as coproduct markets, especially with technologies that add a significant yeast protein to the feed ingredient.

Whether maintaining current markets or enterprising into new ones, distillers grains have become an important revenue stream for ethanol plants. And the opportunities for a polished product are vast.

New Market: Aquaculture

Green Plains purchased Optimal Fish, a boutique lake and pond management feed company that it plans to scale up, Cronin says. “What we really liked was their science and commitment to quality and innovation. So we’re taking that and scaling that to commercial.”

But the key to an optimal fish feed is fractionating, he says. Green Plains uses Fluid Quip Technologies’ Maximum Stillage Co-Products system to accomplish the separation. Green Plains acquired a majority stake in Fluid Quip Technologies in January of this year. “What’s beneficial with MSC protein technology is we basically take the whole stillage that would normally go into a centrifuge and then into a dryer and come out as DDGS, what we’re able to do is fractionate that whole stillage. We end up with a concentrated protein and yeast protein product.”

Green Plains has named that product MSC Protein. It consists of 75% corn gluten and 25% yeast proteins. The system spits out a product with protein purity between 50% and 52%, and Green Plains has achieved 58% protein purity in its applications. Cronin believes Green Plains will hit 60%.

“Protein purity and the potential for this product is very high,” he says. “Higher protein concentration, higher protein purity are the benefits of isolating yeast proteins in one feed.

“The ability of the industry with the MSC technology to deliver this protein concentration—basically that’s what bridges us into the new markets.”

In addition to almost ideal protein, the fish feed ingredient coming out of Green Plains’ MSC applications is low in oil, which is the element that holds xanthophylls, an ingredient that causes yellowing in white fileted fish. MSC extracts 50% more distillers corn oil in Green Plains’ applications, removing that element while boosting extraction to 1.2 pounds per bushel.

Green Plains’ aqualab completes extensive histologies, analyzing all internal organs of the fish and comparing everything to fish fed other diets. “To date, we’ve gotten a very positive response on MSC Protein and filet coloring side by side with other products and have proven the value in that regard.”

One nutritionist says MSC Protein is an optimal fish feed ingredient, Cronin says.

Water quality is another important feature customers want in fish feed, he adds. “Water quality is a huge component in life and health of fish. They swim around in their own feces. The impact of the feed on the water quality, the impact of the feed on filtration systems being used is a key component.”

Cronin says Green Plains is working on even more improvements in water quality, but declined to release details.

The corn gluten and yeast meal is revolutionary in the fish market, he says, and five of Green Plains’ plants have adopted the MSC technology to produce it. Two more will in the coming months. “Scale is important,” Cronin says. “From the process of meeting with the nutritionists, there’s a scaling hurdle we have to get over. Ironically, the more we produce as an industry, we’ll probably start to drive the price higher because there will be more adoption.”

More brands will be willing to buy it with a reliable supply, he adds. “That’s been missing historically but it’s been changing as we grow, as we, Green Plains and others, adopt the technology.”

New Market: Pet Feed

MSC Protein has also made a splash in the pet feed market, where soybean meal is undesirable as it causes flatulence in dogs. “We have a partner in the pet space who absolutely loves this product,” Cronin says. “He hasn’t given us all the secrets about what makes it a great pet feed.”

Yeast for pet health is extremely important, Cronin points out. The benchmarks in that market are shiny coats, bright eyes, firm feces and clean breath.

“From our relationship with our pet customer, our product is a winner in all those regards and the process of the higher protein purity and yeast benefit seem to be key elements of the product relative to the feed ingredients it’s replacing.”

Beyond an exclusive contract with its current pet feed customer, Green Plains is looking to partner with more pet feed brands, Cronin says.

“For protein today, our primary focus is pet feed and aquaculture because the role of the feed ingredient is so important in both of those species,” Cronin says. “We’re working with partners in the poultry space and broiler space, and we’re working with partners in the swine space as well.”

Post-MSC DDGs still have an important role in beef and dairy cattle, he says. “The biggest complaint is the variation in all the factors: protein, fiber, lipids. It has an extreme range of outcomes. That’s across the industry, that’s across our own internal fleet at Green Plains. And the benefit that we get from the post MSC DDGs is a much lower variation in factors.

“We see the benefit on the protein side in entering into new markets, but we also think the post-MSC DDGs is going to be a phenomenal product as well.”

Markets Maintained

Swine, cattle and poultry of course represent markets already using distillers grains for feed, wet and dry. “The market for DDGs is pretty much all species but because our swine and poultry diets in North America are fed in dry form, as opposed to liquid feeding systems, a higher proportion goes to (other) livestock or poultry than beef or dairy,” Shurson says.

Most wet feed goes to local beef cattle feedlots, he says. “It can be used in beef cattle diets in any stage of growth or production but it’s predominantly used for fattening feedlot cattle because of its high energy value. A lot of people continue to think that distillers grains, wet or dry, is a protein source, but it’s really more of an energy source than a protein source.”

There’s been a total acceptance in the feed industry of this coproduct, Shurson says. “One of the things we learned last year when the pandemic turned the world upside down for everyone and ethanol plants either stopped producing or shut down partially, was that distillers grains, wet or dry, had become a common ingredient for all livestock and poultry species and the short supply was a wakeup call to tell the ethanol industry that this is valued and needed.”

Beyond North America, DDGs from the U.S. are exported to Mexico, Southeast Asia, Korea and other areas, says Reece Cannady, manager of global trade with the U.S. Grains Council. But the USGC recently highlighted a market that gets about 3% of the U.S. DDGs exports: Ireland. Ireland purchased more than 277,000 metric tons in 2020, valued at $64 million.

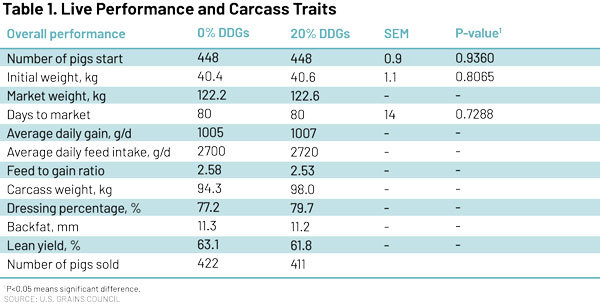

The USGC conducted a feeding trial with a swine farm in the north of Ireland to test the health benefits of U.S. DDGs over competitor feed grains. Results of the feeding trial showed that the inclusion of DDGS leads to healthier and heavier pigs coupled with a cheaper feed cost. (See Table 1.)

“The findings were so good, we actually had to go back and verify again and ask for a double and triple check,” Cannady says.

The results led to direct work with the swine industry to answer questions related to nutrition and encourage inclusion in rations, Cannady says. A large Irish feed mill, which produces up to 500,000 tons of pig feed annually, decided to change its feed formula, increasing the DDGs inclusion rate from zero to 15%. This formulation change will lead to an additional demand for 75,000 tons of U.S. DDGs, annually valued at $17.2 million, according to the USGC.

“It’s so important to do the feed trials in-country,” Cannady points out. “It doesn’t quite work to use figures from the U.S. You have to use their feedstock and use DDGs within that formula. Then it’s easy to convince people to switch.”

But the USGC has encountered an education gap between customers and the product, Cannady says. More webinars are planned with swine producers in Ireland to continue potential market growth. “At this point, we’re still engaging,” he says.

Problem Solving and Partners

Shurson actively promotes communication between ethanol producers and their markets, to educate both parties. “For these ethanol companies and coproduct producers to really understand and obtain the best value they can for the coproducts they’re producing, they really need to develop a relationship or have a consulting nutritionist or a nutritionist on board that can help guide them through some of these kinds of decisions and applications.

“I find that too many ethanol plants kind of expect everybody to embrace and pay top dollar for whatever they can produce coming out the door every day without spending much time on market development and understanding their customers and the animal species’ needs and how they match up with the products they’re producing.”

Cronin emphasizes partners, education and expertise, too. “Our commercial process is we love to partner with companies who have the deep understanding of the role of the ingredients. We’re not hanging a shingle out saying ‘For Sale’ on the product. We’re much more interested in partnering in on a per-species basis.”

Partnerships have helped Green Plains optimize its feed ingredients. A partnership with Novozymes helps Green Plains produce even more specialized feed through the use of tailored enzymes, to help solve issues in certain animal diets. “What can we overcome with feed? It’s very problem-solving focused,” Cronin says.

“The key to entering into these markets is you have to fractionate the DDGs. You have to give individual species markets the feed ingredient that they want. And that’s what the MSC technology allows us to do.”

Lowered carbon intensity scores and sustainability are important factors, too.

“These things are all moving so rapidly and the processes and technologies that allow us to do this are moving so rapidly, it’s a very dynamic and exciting time in this industry,” Cronin says.

“We’re really moving as an industry very, very quickly.”

Author: Lisa Gibson

Editor, Ethanol Producer Magazine

701.738.4920

lgibson@bbiinternational.com

Advertisement

Advertisement

Related Stories

CoBank latest quarterly research report highlights current challenges facing the biobased diesel industry. The report cites policy uncertainty and trade disruptions due to tariff disputes as factors impacting biofuel producers.

The U.S. EIA on April 15 released its Annual Energy Outlook 2025, which includes energy trend projections through 2050. The U.S. DOE, however, is cautioning that the forecasts do not reflect the Trump administration’s energy policy changes.

The Michigan Advanced Biofuels Coalition and Green Marine are partnering to accelerating adoption of sustainable biofuels to improve air quality and reduce GHG emissions in Michigan and across the Great Lakes and St. Lawrence Seaway.

EIA reduces production forecasts for biobased diesel, increases forecast for other fuels, including SAF

The U.S. Energy Information Administration reduced its 2025 forecasts for renewable diesel and biodiesel in its latest Short-Term Energy Outlook, released April 10. The outlook for “other biofuel” production, which includes SAF, was raised.

FutureFuel Corp. on March 26 announced the restart of its 59 MMgy biodiesel plant in Batesville, Arkansas. The company’s annual report, released April 4, indicates biodiesel production was down 24% last year when compared to 2023.

Upcoming Events